Ireland's Shadow Banking System Risks Repeating 2008 Crisis

Ireland is home to the fifth largest shadow banking industry holding some €3.5 trillion in assets - thirteen times the size of the real economy.

Ireland is at risk of a Truss-Style mini-budget financial shock that could mirror the banking crisis of 2008 due to the sheer scale of the unregulated shadow banking sector. While many, including the Irish prime minister or Taoiseach’s economic adviser, have warned that an exodus of multinational tech and pharmaceutical companies could spell the death knell for Ireland’s economic growth this is only scratching underneath the surface. Shadow Banking is an umbrella term used by the Financial Stability Board (FSB) to describe “credit intermediation involving entities and activities outside the regular banking system” such as private equity vehicles, non- bank lenders etc.

In contrast to normal banks which, according to the FSB, ‘issue short-term deposits and invest the money in long-term assets such as loans, leases and mortgages’ the shadow banks fund themselves ‘wholesale through deposit-like instruments and securitization of long-term assets’ with ‘loans, leases, and mortgages securitized and thus tradable instruments.’ Post-crash, Ireland became one of the largest sellers of distressed assets in Europe with the The National Asset Management Agency (NAMA) acting as the bad bank which disposed of the ‘toxic’ loans off the domestic banks’ balance sheets and sold them on to private equity and other vehicles. Many of the transactions and asset transfers conducted by the Irish State via NAMA following the financial crash have ballooned the shadow banking sector: According to the FSB Ireland is home to the fifth largest shadow banking industry holding some €3.5 trillion in assets - thirteen times the size of the real economy. The industry has grown by over 40 per cent since the financial crash accounting for almost half of the global financial sector, according to the United Nations (UN). The worldwide industry is estimated to be worth over $200 trillion. The “core” figure which the FSB says is vulnerable to “bank-like financial stability risks” and “liquidity stress” is worth approximately $67 trillion.

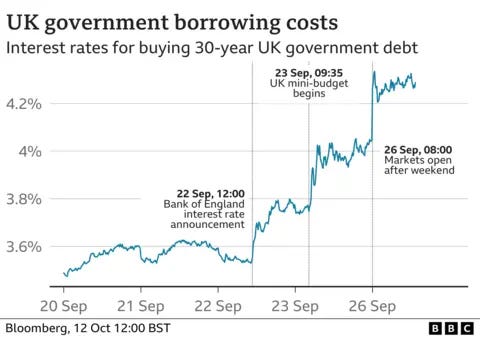

While the shadow banking sector may, as its name hints, lurk in the shadows away from the ‘real economy’ I.e. domestic lenders such as banks, the contagion impact, should these ‘stability risks’ and ‘liquidity stresses’ occur, is a huge risk to financial health. More recently the impact of the Truss-Kwartang mini-budget proved that despite the nebulosity and opaqueness of these financial instruments the impact on wider society can be profound. What happened in the aftermath of the mini-budget was the collapse of British pension funds’ Liability Driven Investments (LDIs). Following the announcement of unfunded tax cuts, which were criticised by the International Monetary Fund (IMF) among others, bond yields rose with a resultant fall in their price which the pension funds needed to make sure their assets, which included bonds, generated enough cash to meet liabilities - the monthly payouts guaranteed to pensioners. As the funds struggled to acquire cash - which acted as collateral - they sold gilts putting further downward pressure on the bond market.

To stem the impact the Bank of England engaged in a £65 billion bond-buying scheme to stabilise gilts. LDIs were sold by major asset managers including Blackrock and reached a whopping £1.6 trillion by 2021. The impact on the real economy was immense. 10-year gilt yields rose from 3.5 per cent to 4.3 per cent before falling back to about 4.05 per cent which saw a surge in mortgage costs for struggling homeowners with monthly payments rising by over £200. Indeed, food price inflation saw a major surge rising to over 10 per cent.

Why do I bring this up?

What the mini-budget debacle proves is that any shock, from any source, can have a wider contagion effect. In 1998 the collapse of the highly leveraged American hedge fund Long Term Capital Management required a $3 billion bailout due to the wider contagion effect. Ireland is particularly vulnerable to these shocks given the sheer scale of the shadow banking presence. In 2008, the State was asked to bail out overseas depositors and bondholders due to their exposure to domestic lending institutions. In a recent assessment of the shadow banking industry, the Irish Central Bank Governor Gabriel Makhlouf said that there are “systemic risks” associated with the shadow banking sector.

To avoid potential economic uncertainty what is required is a reassessment of the overall shadow banking system including what these banks have invested in including property. Right now, there are over 100,000 loans held by non-bank entities in Ireland – 16 per cent of all households in the State - with many of these home loans securitized in wholesale money markets.

When a bank disposes of mortgages off their balance sheets normally they are sold to a US private equity and/or hedge fund who in turn set up what is known as a Special Purpose Vehicle (SPV) which is usually defined as a holding company for the securitization of debt but off the balance sheets of the parent company. As such, the SPV turns the portfolio of mortgages into a securitized loan which is warehoused in Ireland.

According to the FSB Ireland is home to the fifth largest shadow banking industry holding some €3.5 trillion in assets - thirteen times the size of the real economy

This scheme has made Ireland’s International Financial Services Centre (IFSC) the third-largest global shadow banking centre. Under Section 110 of the Taxes Consolidation Act (TCA) 1997an SPV is given charity status which allows them to claim tax neutrality and thus pay no tax on capital gains or VAT. More worryingly, according to the Irish Department of Finance, none of these entities are subject to prudential regulation by the Irish Central Bank (CBI) despite Ireland having the largest securitization sector in the euro area by assets under management. Indeed, the department has also stated that non-Irish registered SPVs are not subject to data regulation. For context, according to IDSA Securitisation securitization in Ireland is predominantly international, with 86 per cent of Irish SPVs set up on behalf of non-Irish sponsors with the US and UK accounting for almost half of all Irish domiciled SPVs (45%), according to CBI statistics from Q4 2015.

Discussion on directly regulating the sector is futile given the inability of regulators to access these opaque structures. However, by regulating some of the methods by which the sector has been allowed to flourish such as Special Purpose Vehicles (SPVs) which are the core of the deeply unpopular ‘vulture fund’ phenomenon the State could clip the wings of this unregulated and volatile sector.

Ireland’s International Financial Services Centre (IFSC) is the third-largest global shadow banking centre

A recent amendment to the Finance Bill proposed by Independent TD Mattie McGrath sought to address the systemic issues with SPVs. The bill aimed to ‘reclassify Special Purpose Vehicles (SPVs) utilizing Credit Servicers – who service loans for investment funds - as ‘investment undertakings’ which would enable ‘Credit Servicers to deduct tax at source and serve as local agents for SPVs in their interactions with Revenue’ and would aim to ‘prevent these entities from evading tax responsibilities.’

He also called out ‘the lack of transparency behind Central Bank closed doors raising significant concerns about potential undisclosed activities.’ While this amendment was defeated, at some point official Ireland will have to address the elephant in the room before America starts calling on us to bail out their hedge funds in a similar way Jean Claude Trichet of the ECB called the Irish government to bail out European depositors in 2008 to the tune of over €60b.

Excellent analysis, Theo! Your deep dive into Ireland's shadow banking sector is both illuminating and alarming. You've done a fantastic job connecting the dots between systemic vulnerabilities, historical parallels, and the risks posed by unregulated entities like SPVs. keep it up!