In 2008, the Irish people were made to pay an over €60b bailout to support the ailing domestic banks who had recklessly lent to developers and offered loose mortgages to borrowers.

While post-crash measures to avoid a repeat of these practices saw the imposition of lending requirements on banks and borrowing constraints on mortgage holders, the emergence of the non-bank sector not beholden to the same regulations has presented itself.

At the end of 2023, almost 40pc of all lending was conducted by non-banks. The Central Bank of Ireland has already warned of the risk of exposure of the Irish real estate market to the shadow banking sector. The Vice President of the European Central Bank (ECB) has warned it could trigger the next financial crisis.

The controversy concerning the sale and acquisition of Docklands Innovation Park in East Wall, Dublin, which was the subject of a judicial review in 2021, offers a microcosm of the wider phenomenon of the non-bank sector’s role in the type of reckless lending undertaken by regular banks in the past. Indeed, it highlights the failure of regulators and the State in tackling irresponsible lending offering an insight into the broader phenomenon of the lack of constraints in the non-bank sector.

According to a timeline provided by The Irish Times, in 1979 the Docklands Innovation Park was under the control of the inward investment semi-state agency the Industrial Development Authority (IDA). Fast forward to 1999, it was sold to a trust established by staff at the Technological University Dublin (TUD) then the Digital Institute of Technology (DIT) known as Bolton Trust. Initially conceived as Docklands Innovation, the trust describes itself on its website as an ‘independent voluntary trust actively committed to assisting people to create sustainable businesses’.

Bolton Trust’s Website

The sale was done on the basis that the site would be used for enterprise purposes with the trust leasing industrial units for start-up companies. During the economically buoyant period of the Celtic Tiger, when borrowing costs were low, the trust borrowed over €3m from Bank of Scotland (Ireland) in order to invest on the site. But following the economic crash in 2008, the trust found itself unable to make repayments and accumulated debts almost equal to the entire amount it borrowed. The woes afflicting the embattled trust heightened after the bank they borrowed from refused requests to halve debt payments from €25,000 to €12,500. This meant they were in breach of the original loan. The debt accrued was eventually transferred over to a U.S. investment fund known as Feniton Property, one of the many investment funds that entered Ireland following the crash to acquire distressed debt. As part of the agreement, Bolton Trust was required to sell the site which needed ministerial approval. The Enterprise Minister at the time Mary Mitchell O’Connor signed a consent order releasing the site’s IDA covenants in March 2017 as part of a “disposal of IDA’s residual interest”. According to the Irish Times: “The trust entered talks to the IDA and its advisers, leading to a deal to buy out the covenant for €350,000”. The estate agent Lisney carried out an independent valuation of the site and said the deal “represented a good and fair offer for the IDA” and advised the body to accept Bolton Trust’s offer to buy out the IDA’s interest in the property.

The sale required Government approval to proceed. Even though the sale was not made on the open market, Minister of State for Enterprise, Mary Mitchell O’Connor nonetheless approved the sale.

In April of that year, a newly established company EWR Innovation Park Ltd bought the site for €5.6m. Despite receiving government approval, Bolton Trust never engaged in an open tender process and refused to liaise with an estate agent. EWR is led by a man named Edward McHugh. Described by The Sunday Times as a “low profile Galway businessman”, he hails from Claregalway and has been involved in several business ventures including, but not limited to, the production of capsules and an antioxidant oil called astaxanthin. He is currently general manager of a Galway medical manufacturer Dawnlough Ltd according to his LinkedIn profile. On its website, the company states that they “provide a complete range of premium manufacturing solutions to a wide variety of companies in several sectors including MedTech, Aerospace and Automotive industries”.

Dawnlough Website

EWR was established on 10th August 2016 by Edward McHugh. According to The Ditch, EWR’s latest CRO filings show that it owes creditors almost €9.5 million. The company had less than €100 equity when it was founded. He was introduced to the Bolton Trust by his brother-in-law Henry Cleary who is a former member of the Fianna Fáil Ard Comhairle and chairperson of the Galway Races Ball described as the “hottest show in town” under the reign of Taoiseach Bertie Ahern. In May 2013, the Mayo Advertiser reported that ‘Mayo accountant Henry Cleary was elected to the Committee of 20 representing members on the Ard Comhairle, beating off stiff competition from other members’. He is currently a member of the executive committee of Barclays Bank Ireland and head of the bank’s structured finance and structured property finance. He was previously a senior consultant in auditing at KPMG.

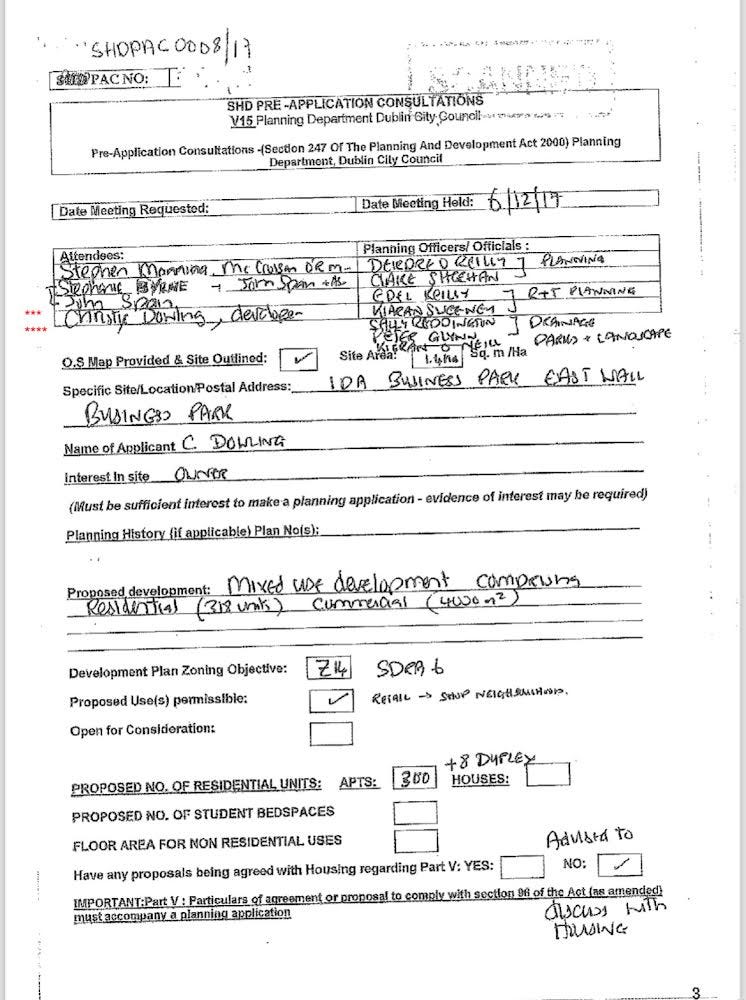

While McHugh declared himself director of the company, businessman Christy Dowling, whose companies remain indebted to the State’s bad bank the National Asset Management Agency (NAMA), was named as the East Wall Road site’s “owner” and “developer” in a Dublin City Council SHD pre-application consultation (below).

McHugh, using an affidavit, denied Dowling’s ownership but an affidavit for the park’s tenants and leaseholder Atlantic Diamond Ltd said that Christy Dowling had claimed “myself and another lad” bought the site.

But who is Christy Dowling?

He is the Director of Vestry Limited Partnership and Co-owner of the Newlyn Group of companies, the latter of which had €22m in loans transferred to NAMA in 2011. According to the Irish Times, his latest employment was with Arrow Asset Management. On Newlyn’s summary, it states that it was set up in February 1997 with a partial address in Dublin 2. The company has a single shareholder. Dowling co-owns the company with a man named Robert Kehoe. They both made a €1,500 donation to Fianna Fáil TD Joe Behan in 2007. Dowling’s wife Hilary is a co-director in Newlyn as well as four other companies. According to the Irish Times: “Nama has charges over the assets of two other companies in which Christy Dowling but not Hilary Dowling is a director and shareholder – Newlyn Developments Ltd and Blossomglen Ltd.

“Accounts recently filed show the loan facilities of Newlyn Developments, which had €15.58 million in net liabilities in 2022, were held by Nama.” His other company Vestry Limited was founded by Dowling, Kehoe and the former CEO of Chartered Land Andrew Gune. The company is involved in purchasing homes and renting them out to tenants at extortionate prices. In April 2023, The Ditch reported that the fund, described as “one of the biggest landlords in the state”, had in the last six months bought more than 150 second-hand homes with one property advertised for almost €2k p/m. The previous September the same media outlet reported that Vestry Ltd “owned more than 850 second-hand properties it had bought in the last three years”. Outlining the company's net worth, The Ditch mentioned: “With a property portfolio worth well in excess of €200 million and claimed profits of more than €20 million for 2021, the fund itself doesn’t pay tax in Ireland, with its investment partners instead liable”. In June 2023, The Sunday Times reported that Vestry is backed by a Singapore sovereign wealth fund and had amassed more than 1,000 rental properties throughout the country having, according to sources, acquired a large number of properties from the controversial vulture fund Cerberus. In September 2023, The Irish Independent reported that Vestry owned more than 1,000 properties earning rental receipts of €25.5m between September and June 2019. The paper reported that some of their tenants had racked up arrears of close to €200,000 with the fund ultimately unsuccessful in enacting an eviction for failure to prove to the Residential Tenancies Board (RTB) that they had breached their lease contracts.

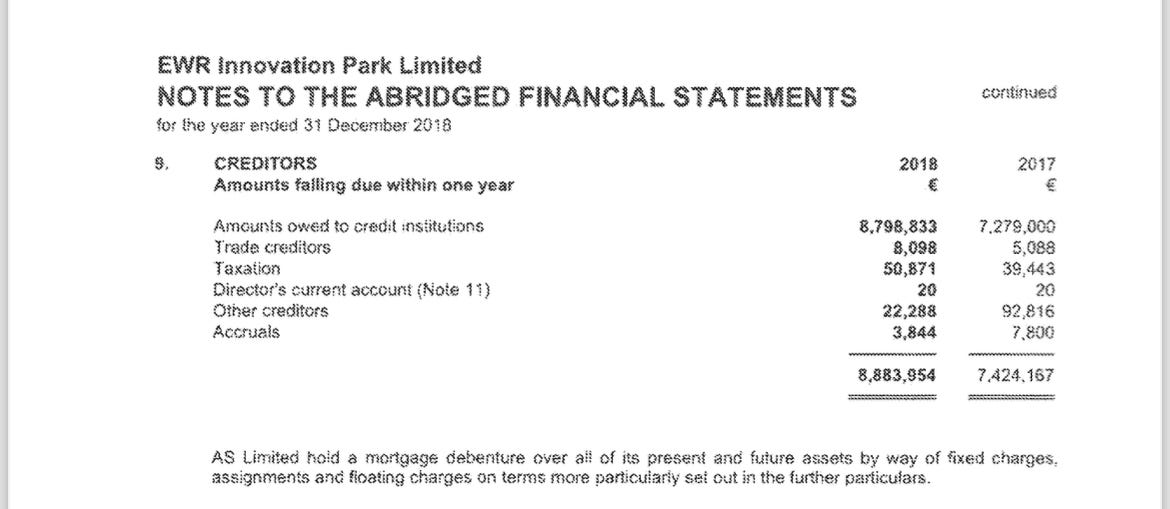

As such, McHugh financed the purchase of the site with a loan of €6.5m from a company named AS Limited based in the Isle of Man (below).

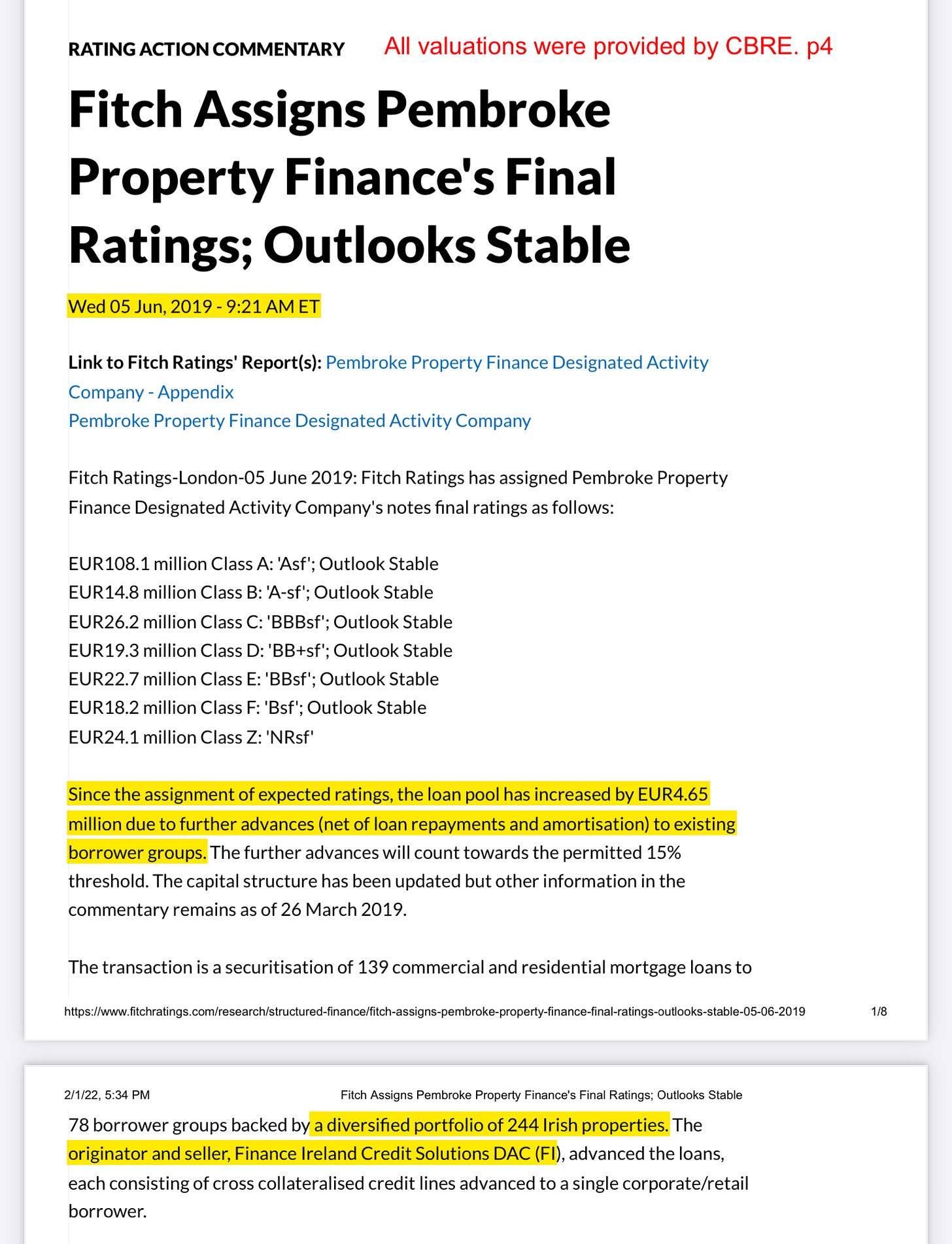

Having struggled to pay that loan they received a separate low interest loan with the partly state-owned non-bank lender Finance Ireland in 2019. The non-bank lender refinanced the original loan providing over €9m despite the site being bought for €5m and with EWR’s €100 equity remaining unchanged. Finance Ireland was founded in 2002 by Billy Kane and employs 170 people. On its website, it is described as “privately owned” and “the largest non-bank lender” in the State. The Irish Strategic Investment Fund (ISIF) held a 32pc stake in Finance Ireland from 2016 to 2022, which included the period of the loan in question.

Finance Ireland website

In a letter, sent on 21 October 2021 by registered mail, the Finance Ireland C.E.O. Billy Kane was advised that the person recorded on official documents as the owner was a front for the beneficial owners, one of whom was Christy Dowling. With no reply forthcoming the letter was subsequently sent to finance minister Paschal Donohoe. The contents of the letter were later reported on by The Ditch in March 2024: It is in public record that a private financial institution, Finance Ireland, provided a property-backed loan of almost €10m to a company with €100 equity and that the loan is secured against a site that was purchased for €5.6m two years previously. Why are the savings of Irish pensioners being used to support this type of lending, and what social good is achieved by it. The unnamed whistleblower later had a meeting with Fine Gael Councillor and then adviser to the minister Ray McAdam who was “taken aback” by the scale of the allegations. However, neither he nor Minister Donohoe followed up on the allegations. Cllr McAdam was contacted for comment.

Two weeks later McHugh transferred half his shares in EWR to Christy Dowling’s wife Hilary Ward who, according to the Irish Times, along with her husband, is co-director in four companies with charges on the assets in one of those Newlyn Homes Ltd and is owner of all the shares in Silk Shadows Ltd which is owned by Newlyn. Incredibly, Donohoe, fully aware of the alleged improprieties at Finance Ireland, later signed off on a deal that saw the non-bank lender as well as Dilosk share €1b in funding from Bank of Ireland following approval from the Competition and Consumer Protection Commission (CCPC) through the purchase of residential mortgage-backed securities to be issued in the future.

But how did EWR manage to acquire such a massive loan exceeding the land’s value?

Overvaluation ?

At the time, Christy’s brother, Willie Dowling, was a director in the commercial real estate firm CBRE. In a letter seen by this writer, dated 24th September 2018, Willie Dowling advised Atlantic Diamond Ltd that he was asked by the owners of the site to inspect the unit for an upcoming rent review.

In an affidavit cited in court orders for Atlantic Diamond, it was stated that Willie Dowling had visited the company premises on 12th October 2018 mentioning that the owners would like to buy the leasehold. It is said that he visited again on 25th October 2018 where he tabled an offer to acquire a leasehold interest from Atlantic Diamond. But throughout the early period of negotiations, Willie Dowling, it is alleged, failed to disclose who the estate owners were. According to the affidavit, it was later disclosed that the owner of the site was ‘Christie’ Dowling, described as his brother.

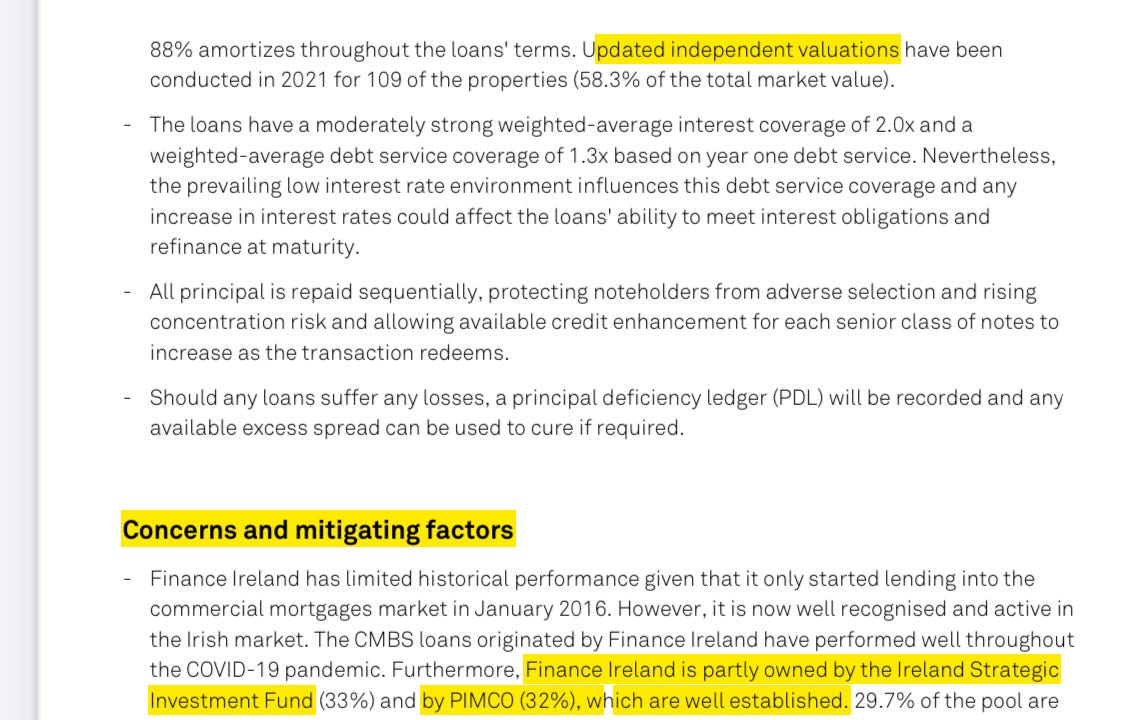

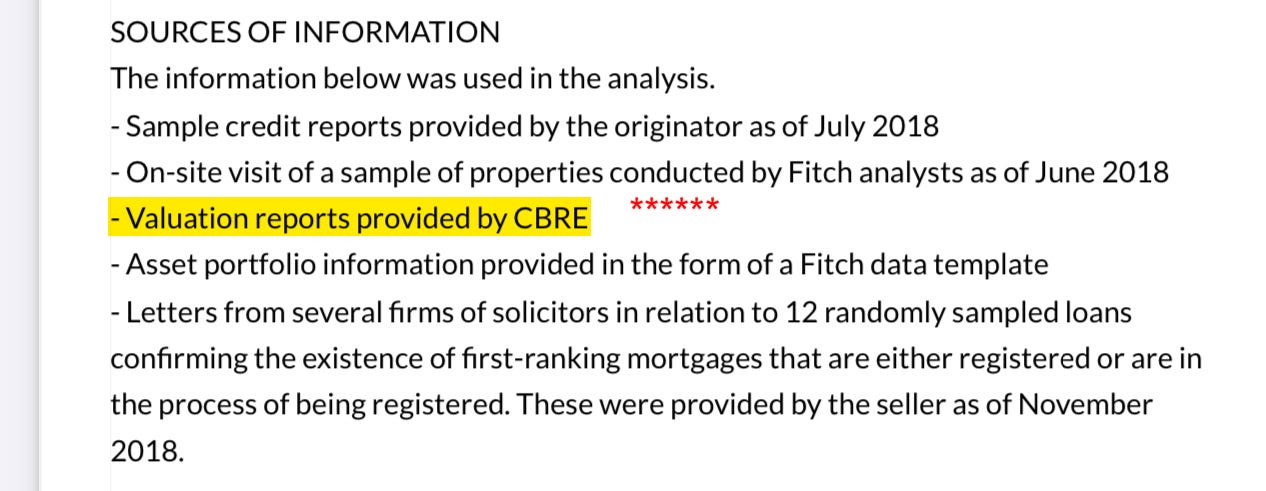

The affidavit mentioned that Bruce Campbell, described as a colleague of Willie Dowling’s, also of CBRE, calculated a valuation of €18m described as “more than three times the purchase price paid to the Bolton Trust… less than two years previously” which “has also been used in Part V calculations of the developer's planning application”. It is unclear whether this inflated figure was used to acquire the loan from Finance Ireland in 2019. In May of last year, The Irish Times reported that Dowling had moved from CBRE after 27 years to Colliers to take up the role of director.

Both Christy and Willie Dowling were contacted for comment.

Securitisation

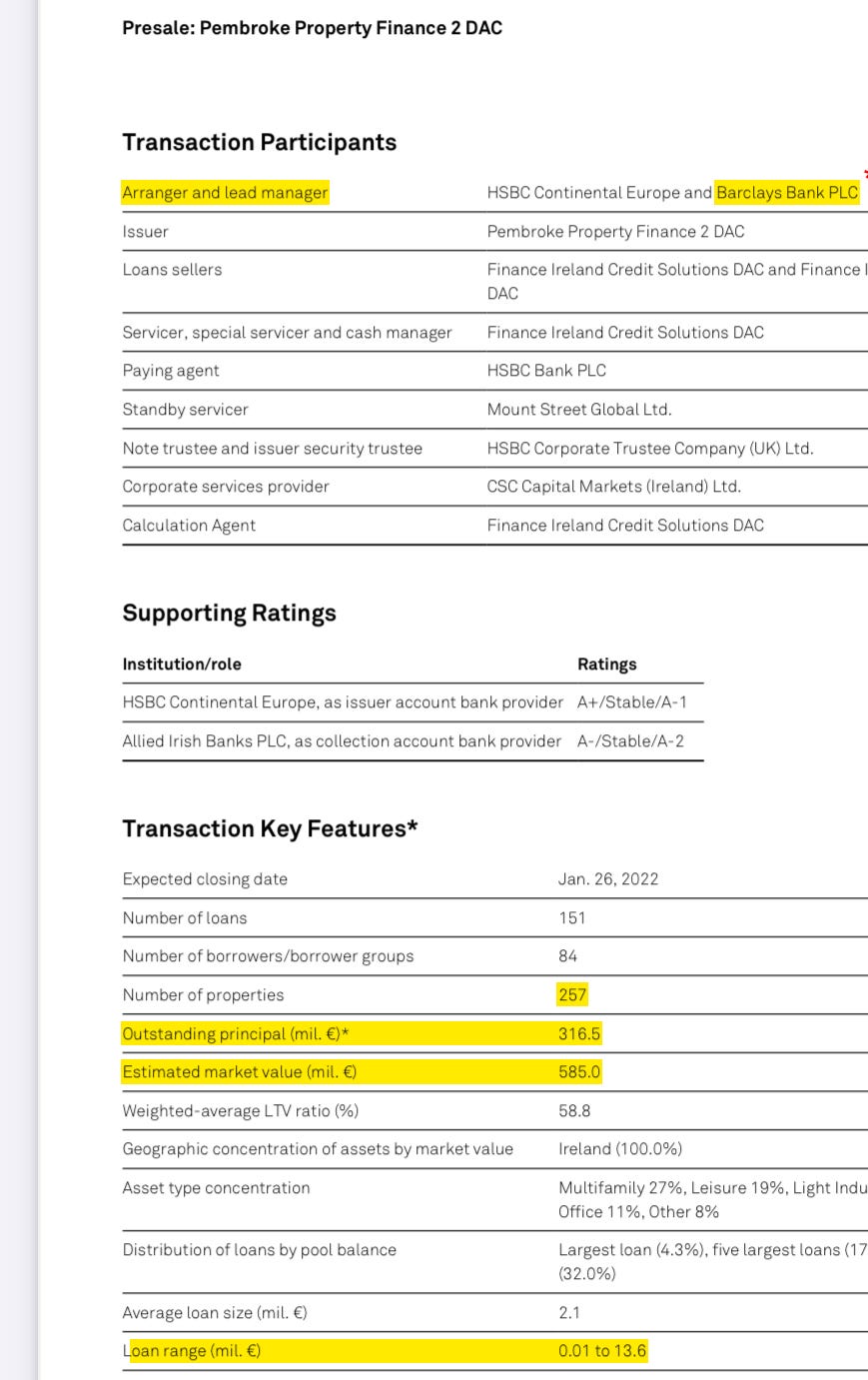

In June 2019, shortly following the valuation, a securitisation was issued by Finance Ireland for 139 commercial and residential mortgage loans. These would be offered to 78 borrower groups backed by a diversified portfolio of 244 Irish properties. The originator and seller, Finance Ireland Credit Solutions DAC (FI), advanced the loans, each consisting of cross-collateralised credit lines advanced to a single corporate/retail borrower.

This would require independent verification. Barclays, who the initial conduit in the sale Henry Cleary works for, also played a role in the securitisation having acted as arranger and lead manager (below).

Planning Permission

In October 2019, EWR applied for planning permission on the site to include 336 apartments under the Strategic Housing Development (SHD) application which allows applicants to bypass local authorities and go directly to the planning board, An Bord Plenála (ABP). The planning included the “demolition of existing buildings, construction of 336 apartments, childcare facilities and associated site works”. As part of its Part V requirements under the Planning and Development Act 2000, EWR was required to sell 10pc of the units for social housing to Dublin City Council. But according to a report in The Ditch, EWR vastly overstated the cost of the development land erroneously increasing the valuation by €1.1m, as referred to in the affidavit, in order to extract more money from DCC and the taxpayer:

“EWR claimed in its application to ABP – using a single line, without supporting evidence – that land costs for the social units was €1,631,244. Though EWR had bought the site for €5.63 million, this new valuation would’ve put the full site’s value at €18.2 million. If EWR had used the figure it purchased the site for €5.63 million – the land costs would’ve been €493,000. The developer’s increased valuation would’ve resulted in an extra €1.1 million in costs to DCC”.

To add insult to injury EWR was not charged the mandatory €750,000 in statutory fees ABP should have collected despite the state agency for transport infrastructure Transport Infrastructure Ireland (TII) requiring such a charge. This was separate to the SHD application. Both the overvalued social housing and failure to apply statutory fees were approved by the same three members of ABP Michelle Fagan, Terry Prendergast and former deputy chair Paul Hyde.

In June 2023, Hyde was sentenced to two months in jail after he pleaded guilty to making false or misleading declarations of interest to ABP. He later avoided jail time on appeal.

In a recent scoping investigation into governance at ABP, Senior Counsel Lorna Lynch found there were no sufficient grounds to refer matters to the Minister for Housing to determine if there was "stated misbehaviour" to six governance areas, which involved reviewing 175 case files and interviewing 17 relevant people.

A judicial review for the planning permission involving the apartments was later initiated against the board with EWR as a witness party in the High Court by Atlantic Diamonds Ltd. Atlantic objected as they argued that heavy goods vehicles would come into the development area at “unsocial hours” which included the “operation of noisy industrial equipment outdoors”. In those proceedings, it was stated in an affidavit that Christy Dowling had said that “myself and another lad” bought the site in the East Wall Road. In 2021, the Court denied the planning permission. In the judgement, the presiding judge Richard Humphreys said that ABP displayed a “certain laxity in scrutiny, involving in effect the cutting and pasting of the developer’s materials, without adequate critical interrogation”.

Very interesting but not at all Surprising !