Donald Trump’s impressive electoral feat in 2016 can be boiled down to several competing objectives: more jobs particularly in manufacturing, less immigration both legal and illegal, and asserting American hegemony by countering China. Trump, under the banner of ‘America First’, vowed to onshore American industry exported to far-flung regions, mostly in Asia, and deport migrants who, for the most part, were brought in to fill in for native workers who had specialised in manufacturing but are now deemed redundant in a services dominated economy. For years, American elites turned a blind eye to the aftereffects of globalisation in which jobs were siphoned off to China by avaricious domestic industrialists desperate to cut costs and realpolitik politicians eager to counterbalance lingering threats in a geopolitical powerplay against the Soviet Union which included democratising China through integrating them into the global economy. This birthed a new disenfranchised domestic political group in the U.S what we know now as the ‘Rust Belt’ – spanning from Baltimore to Rochester – a socially eroding metaphor that refers to the decrepit urban milieu of a once bustling and robust manufacturing sector whose demise has meant decay. But as Trump failed to bring those jobs back and halt Beijing’s meteoric rise in his first term, he has now started listening to tech moguls who have convinced him that the only way to revitalize U.S growth is by importing more workers from other countries to kickstart emergent and futuristic tech-industries including semiconductors and Artificial Intelligence (AI), thus backtracking on his previous pledge in 2016 to curb all forms of immigration. This, he’s told, will see America ahead in the technology race. While the Cold War against the Soviet Union was fought over ideology the battleground in this latest geopolitical skirmish against China is tech with the tech overlords or ‘tech bros’ wielding tremendous influence in the incoming administration to see through their overriding ambition - the nationalisation of Silicon Valley precepts.

The Rise of China and Fall of the Rust Belt

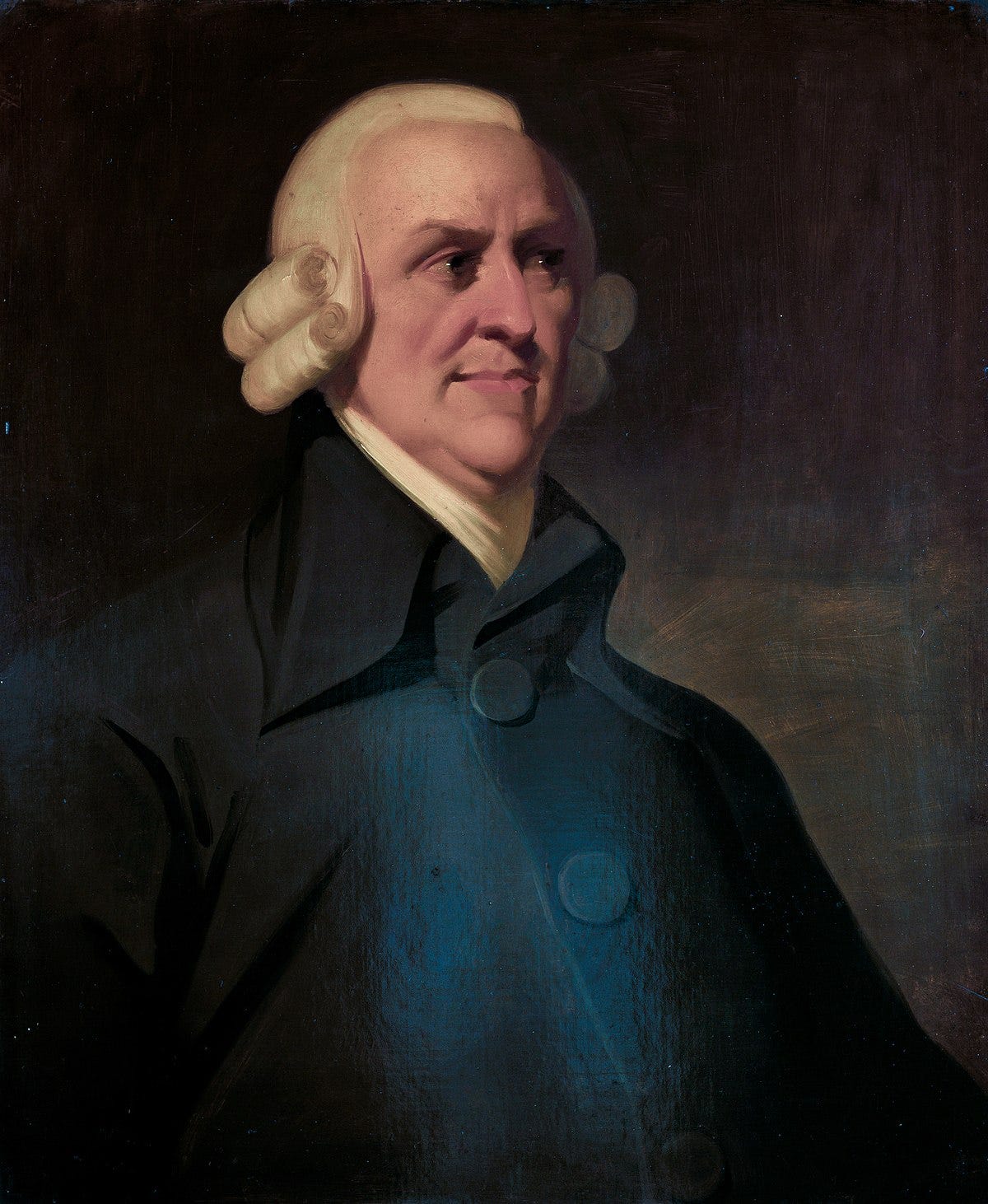

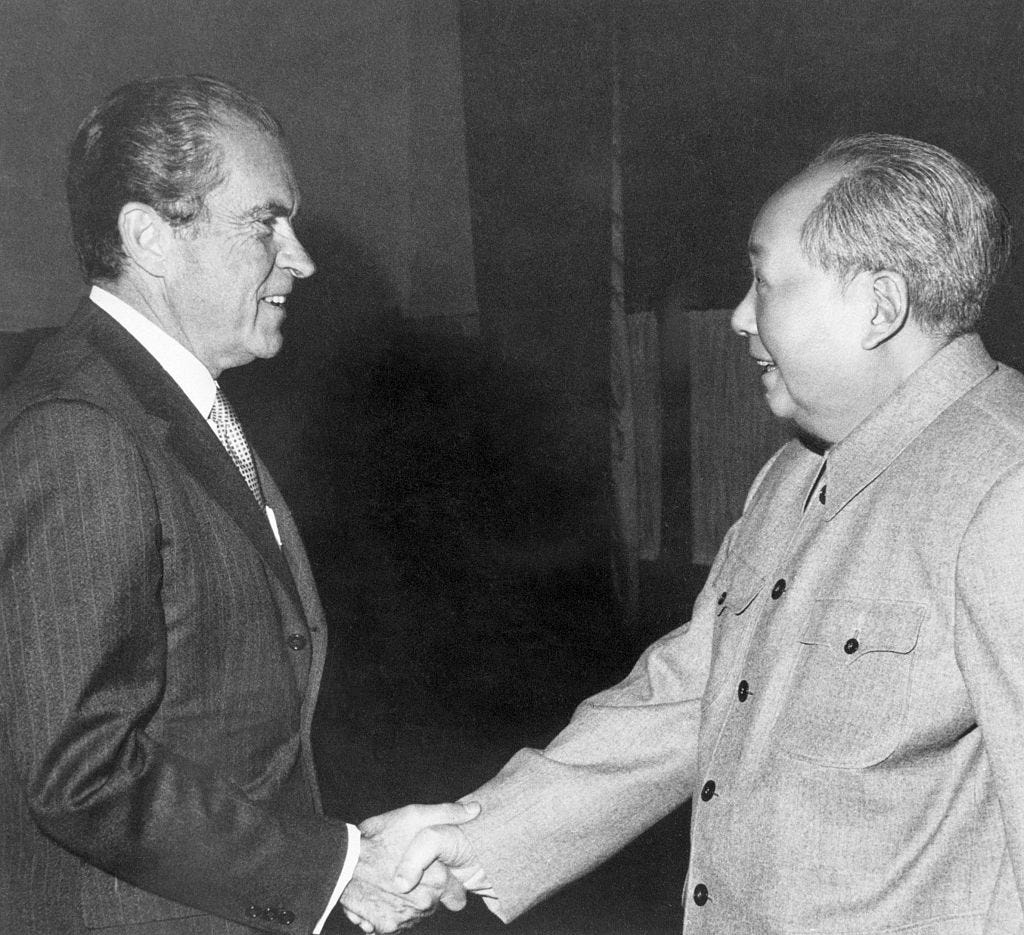

Every facet of America’s managerial and political class played a role in the decades-long betrayal of the U.S. Rust Belt. Successive administrations from Jimmy Carter to Bill Clinton embraced the cuddly Chinese Panda Bear believing it to be tame relative to the Russian Brown Bear. The confluence of of big business desperate to cut costs by importing cheap goods produced by low-wage Chinese labour and the U.S government whose geopolitical ambition at the time was to sidestep the Soviet Union by pushing Beijing and Moscow further apart, or what national security adviser Henry Kissinger referred to as “triangular relations” which involved opening relations between China and the West as Sino-Soviet relations deteriorated, in time would see America grow ever more reliant on China. Writing for Livemint, Diva Jain outlines how instrumental Washington was in the economic rise of China by granting the country Most Favoured Nation (MFN) status which enabled its access to global banking credit alongside a vast export market in the form of American consumers all facilitated by U.S mega corporations. The U.S., she says, would look away as China flouted World Trade Organization (WTO) rules and human rights violations most notably the student-led Tiananmen Square protests in 1989. From a commercial perspective, the facilitation of cheap goods from abroad was articulated by Adam Smith in his seminal piece of work The Wealth of Nations (1776):

“If a foreign country can supply us with a commodity cheaper than we ourselves can make it, better buy it of them …. In every country it always is and must be the interest of the great body of the people to buy whatever they want of those who sell it cheapest. The proposition is so very manifest that it seems ridiculous to take any pains to prove it; nor could it ever have been called in question had not the interested sophistry of merchants and manufacturers confounded the common sense of mankind. Their interest is, in this respect, directly opposite to that of the great body of the people”.

At the time of writing, China is the world’s largest economy on a Purchasing Power Parity (PPP) index metric. Indeed, those bearish on China including Peter Zeihan and Michael Pettis among others insist China’s twin ‘crises’ of demographic decline and a property crisis spell demise but have yet to be vindicated. Despite these doomsday prognostications, China still manages to achieve its yearly growth target of 5pc with its property woes easily alleviated through the utilisation of Asset Management Companies (AMCs) which simply eliminates all ‘toxic’ property loans off the balance sheets of the state-run banks.

China’s rise was aided and abetted by the West and the country is not going anywhere anytime soon.

Two case studies typify corporate America’s commercial decision to enable China’s rise to raise their profit margins: the Walton family and Tim Scott, owners of the cheap and cheerful American retail corporate giant Walmart and the CEO of Apple Technology, respectively.

Walmart is nationally renowned for its wide range of cheap products and services that suit Americans’ propensity for gratifying retail decisions. Offering everything from groceries, gas and home furniture, Walmart has it all. Having lived in America for a few years and occasionally venturing into Walmart, scanning across the aisle in the advanced mega convenience store, I was rarely left wanting upon departing. However, my cart was usually filled with useless items. Clearly, the business model is a catch for consumerist Americans with Walmart recording over $100b in sales in Q3 this year. However, behind the façade of inexpensive shopping lies a sinister mercantile deceit. In 2013, Walmart purchased close to $50b worth of goods from China accounting for over 15pc of America’s trade deficit with the country and has only increased since.

The quid-pro-quo involved in these massive purchases suited American elites: China would sell Walmart cheap goods - with cheap labour - that ordinary Americans would purchase. Beijing would use their dollars to purchase U.S debt or bonds and other assets so it can keep those exports competitive as the renminbi’s value would remain low relative to the high demand dollar. Bond prices and yields have an inverse relationship. So, when demand for bonds is high their yield falls. This low yield allows America to sustain such a high debt rate – if demand for U.S. debt is high it means, inter alia, lower mortgage costs for American homeowners and they also get cheap goods!

That low debt servicing cost also allows America to fund public infrastructure such as roads and bridges. China currently holds $1t of the over $20t U.S Treasury market. But while this may benefit families like the Waltons and some mortgage holders this devil’s bargain took the above-mentioned Rust Belt as collateral damage. From 2001-2013 over 400,000 jobs were lost because of the Walmart-based trade deficit mainly in manufacturing.

In the generationally charged book Boomers: The men and women who promised freedom and delivered disaster Helen Andrews outlines how Tim Cook, in contrast to his predecessor Steve Jobs, welcomed Chinese input into Apple with open arms: “It was Cook who cultivated Apple’s close relationship with Foxconn, the Taiwanese company that is now the largest private employer in mainland China”. She further highlights how “Cook’s first overseas trip as CEO was to Beijing” and was crucial in Apple’s moving production to Asia at the turn of the 21st century. According to Forbes Magazine, Foxconn’s factories in Shenzen southeastern China have up to 500,000 workers with over 90pc of iPhones, AirPods, Macs and iPads made throughout the country. Taken as a whole, job losses in the computer and electronic industry account for 1 million of the more than 3 million manufacturing job losses since U.S. companies shifted operations to China.

The Rust of Flint

Nowhere else embodies the Rust Belt more than Flint, Michigan. Home to General Motors (GM) car manufacturers the town once boasted the namesake “Vehicle City” on account of its teeming automobile industry with an 80,000-strong labour force. Now the town is in the headlines for all the wrong reasons.

Whether it’s the public health crisis from 2014-2019 in which lead contamination in the water supply led to an outbreak of Legionnaires’ disease or its spiraling crime rate, Flint is a test case in what Americans may call fly-over states left behind by globalisation. Since the onset of globalisation, that 80,000-employment figure has shrunk dramatically by 75,000 leaving rust in its wake as America has opted for cheaper manufacturing in China and Mexico

The left-wing filmmaker and Flint native Michael Moore, who sought to rationalise Trump’s appeal from a left-wing perspective, produced the documentary Roger & Me that explained the predicament faced by his hometown. Named after the CEO of GM Roger Smith, the documentarian attempts to confront the cost-cutting industrialist as he did the NRA CEO the late ‘from my cold dead hands’ Charlton Heston in Bowling for Columbine. Having failed in his pursuit he remarked, “As we neared the end of the twentieth century, the rich were richer, the poor, poorer. And people everywhere now had a lot less lint, thanks to the lint rollers made in my hometown.”

Tariffs: A Silver Bullet?

Donald Trump’s signature campaign pledge in 2016 was to onshore these industries from abroad back home. In 2016, voters in the top 25 manufacturing-heavy U.S. states gave up to 80pc of their votes to Trump. He vowed to deploy several mechanisms to achieve that end including using tariffs – duties on imported goods – and trade deals. Trump has seldom hidden his lust for tariffs once saying: “To me the most beautiful word in the world is tariff.” But why is Trump so infatuated with tariffs? It all goes back to his obsession with closing America’s trade deficit especially with China. Since 1982, America has been a trade deficit nation.

The U.S. trade deficit with China in particular has widened dramatically in recent years. In 1985, shortly following Deng Xiaoping’s economic reforms which began in earnest in 1978 and eventually saw 700 million Chinese come out of poverty, American imports from China were worth $2.7b while exports to China reached $2.4b. This is technically a trade deficit on America’s part but not by much. However, by 2022, imports from China totaled $500b with exports reaching $200b meaning a trade deficit in goods and services of $367.4b. But does this even matter? In theory, given America’s current status with its currency the dollar as the reserve currency it shouldn’t. Economics 101 tells us that when a country has a current account deficit the value of its currency falls making its imports more expensive and exports cheaper; on the other side of the coin, if a country is running a current account surplus their currency should rise in value making exports more expensive and imports more cheaper. However, even with America’s perennially high trade deficit its currency has risen. It’s what former French Finance Minister Valery Giscsrd d’Estaing referred to as America’s “exorbitant privilege” being the reserve currency meaning it will always be in high demand regardless of its current account balance, at least as it remains the reserve currency. Indeed, according to the St Louis Federal Reserve the U.S. earns a higher rate of return on its overseas assets such as private equity and Foreign Direct Investment - high risk ergo high yield - than it pays on its liabilities to other countries guaranteeing net inflows despite being a debtor country. But Trump and other economic nationalist conservatives are worried that in the long run, the growing trade deficit will make other countries lose confidence in the dollar and hinder economic growth accelerating calls for an alternative to the dollar. In his first term, his tariff policy failed to yield any significant results. Despite performative stunts such as announcing the return of manufacturing to specific localities including 13,000 jobs in Wisconsin at a Foxconn plant, which remains empty to this day, his protectionist policy failed to materialise sufficient gains.

Despite singling out China as a ‘currency manipulator’ and placing various tariffs on Chinese imports, not only did the dollar rise but the trade deficit with China widened during his first term in office. While there was an uptick in manufacturing from 2016-2019 in the order of 500,000 jobs this was simply the continuation of a trend that began under his predecessor Barack Obama. Adding insult to injury, while there was no net return of jobs Americans nevertheless felt the pinch: According to the left-leaning economic think-tank The Journal of Economic Perspectives, ‘import tariffs cost US consumers and the firms that import foreign goods an additional $3.2 billion per month in added tax’. Simply put, the Trump tariffs raised the price of everyday goods without addressing the underlying problem causing the trade deficit which is an appreciating dollar relative to the yuan which keeps China’s exports dominant. Instead the Trump administration should have taken a leaf out of the Reagan administration’s book when America sought to rebalance its trade deficit with Japan - then the dominant exporter - under the Plaza Accords. Named after the hotel in New York City where it was negotiated this agreement saw the U.S devalue the dollar relative to the French franc, German deutschmark, British Pound and Japanese Yen to restore its exports.

But how did America become the reserve currency? And what have tariffs historically set out to achieve?

History of Tariffs

While Trump may defy the free trade consensus of his predecessors, particularly within the Republican Party, tariffs have long been advocated throughout U.S. history to protect native industry. The first American Treasury Secretary Alexander Hamilton once stipulated such levies were required to ‘break the nation’s continued dependence on British trade and manufacturing’ with the U.S constitution specially sanctioning such trade policy. At one point, tariffs were as high as 50pc representing 90pc of the U.S’ tax revenue. Generally, it was the industrial North that favoured tariffs to the detriment of the agricultural and export-heavy South. But as America implemented new taxes including income tax in 1913 it gradually lessened its reliance on this revenue-raising mechanism. In the aftermath of the 1929 Wall Street Crash, the prelude to the Great Depression, the Smoot-Hawley tariffs were implemented which saw imports to and exports from Europe fall by around two-thirds. These punitive measures would be the last major tariffs enacted by the American government. In 1944, as war continued to rage across Europe, the Bretton Woods Agreement saw 44 countries namely Western Europe, the U.S, Canada and Australia convene in New Hampshire which saw them agree to peg their currency to the U.S dollar-convertible to gold which was now cemented as the world’s reserve currency meaning all these nations would have to hold dollars in reserve. In 1972, Richard Nixon ended fixed exchanges and the delinked the dollar with gold but the dollar remained the reserve currency.

So confident was the U.S in its newfound economic dominance it vetoed a proposed international currency and global bank called ‘Bancor’, the brainchild of John Maynard Keynes, which would’ve seen trade imbalances ameliorated but because America was, at the time, a trade surplus nation it nulled such a proposal. The General Agreement on Tariffs and Taxes (GATT), the predecessor to the WTO (1995), in 1947 saw 23 countries agree to eliminate tariffs, quotas and subsidies thus ending centuries of deploying tariffs as an economic policy.

The Second Trump ‘Tech-Bro’ Term

The incoming Trump administration seems determined to continue de-coupling the U.S. from China. Trump has already announced plans to impose tariffs on China 10pc above the 25pc proposed tariffs on all imported goods from Canada and Mexico. However, in Trump’s rush to upend China’s hitherto unfettered rise to the top he has been listening to various technology gurus dubbed ‘tech bros’. Many of these tech bros have influence within the upper echelons of the incoming administration most notably Tesla CEO Elon Musk who bankrolled the successful campaign to the tune of $277m and is head of the incoming administration’s Department of Government Efficiency (DODGE) which seeks to eliminate what the tech world deem cumbersome and unnecessary regulations. In many ways, it was big tech that got Trump elected particularly the medium of Twitter which enabled him to circumvent traditional media. When Musk purchased the social media product and rebranded it X to enable free expression this crystallised his newfound role as a key propagator of this latest iteration of Trump’s MAGA movement. So what are these tech bros telling Trump? They’re telling Trump that the only way to combat the rise of China is by investing in futuristic technology including AI and semiconductors. According to the International Monetary Fund (IMF), AI could impact 40pc of global employment which rises to 60pc in advanced economies. Meanwhile, semiconductors are a vital component for almost all electronics including smartphones and laptops, and with China increasingly offering alternative products to Western-dominated companies including Huawei in lieu of Apple, the U.S. feels threatened by being overtaken in the electronics market. While the rise of China was facilitated as part of a Cold War with the Soviet Union that saw the two ideologically competing geopolitical rivals export ideas namely communism and capitalism, respectively, this time around the battle is over technology with the U.S. seemingly intent on putting China down a peg or two having hitherto enabled their economic ascendance. But how might America do that you may ask. Under Joe Biden’s administration, the U.S. has attempted to protect its semiconductor industry through industrial policy and import restrictions via the Creating Helpful Incentives in Producing Semiconductors or the CHIPS Act. According to the Council on Foreign Relations (CFR), in the 1990s the U.S. produced 40pc of the world’s semiconductors compared to the current measly 12pc with Taiwan vastly surpassing at 60pc which rises to 90pc when taking advanced semiconductors into account. The CHIPS Act offered over $50b in federal funding for domestic companies that invested in semiconductors along with a 25pc tax credit. Musk’s own company Tesla, which specialises in Electric Vehicles (EVs), has availed of these credits and has also benefited from restrictions on EV imports from China. While these domestic incentives were largely successful and an example of effective industrial policy, given the interdependency that the semiconductor industry has with the wider world many of the import restrictions were negligible at best and damaging at worst. To examine this let’s take the case study of Micron Technology. Based in the U.S. State of Idaho Micron’s semiconductor technology was banned from entering China for allegedly posing “serious network security risks”. This was part of a series of tit-for-tat moves including the U.S. ban on Gen-Z’s favourite app TikTok for supposedly being a front for Chinese espionage. While the hope was that China would be isolated in cutting itself off from a major U.S. chipmaker Beijing simply substituted Micron’s technology with similar components in South Korea despite Washington’s protestations to the latter. According to the Macroeconomist Philip Pilkington, “The only way America can make its trade war work is to convince a substantial slice of the world economy to put in place similar restrictions to those being imposed by Washington”. But while export controls and industrial policy may play a role in the second Trump administration the aforementioned tech bros have also convinced Trump that by allowing legal migration to flourish, particularly via the controversial H-1B Visa Scheme, the U.S will have the labour talent needed to staff the strategically vital industries needed to fuel the tech economy.

The H-1B scheme has long been prominent in America’s polarised immigration debate. The H-1B scheme is a non-immigrant visa which allows employers to import workers from abroad in so-called ‘speciality occupations’. The applicant is sponsored by an employer and must possess the necessary qualifications with a bachelor’s degree in the specific field at a minimum. Applicants can stay in the U.S. for up to six years with many using the scheme as a gateway to a visa with caps set at 65,000 applicants per annum with an additional 20,000 for those who have graduated with a postgraduate or a higher qualification from a U.S.-based college or university.

While it may sound analogues to a well-intentioned scheme to fill labour gaps in much-needed industries it has been heavily criticised by employers groups, commentators and even then-candidate Donald Trump in 2016. Writing for UnHerd, Lee Fang mentions that the scheme has evolved through the years to incentivise workplace exploitation of foreign labour:

“Originally designed in 1990 to plug a gap in scientific and technological knowledge, and to bring over foreigners of “distinguished merit and ability”, there are safeguards which are supposed to prevent corporations from exploiting the H1B visa to harm American workers. But inevitably, these loophole-ridden rules are easily manipulated by employers who favour foreign workers, and are using them to undercut American wages.”

According to one estimate 80pc of H-1B visas go to computer programmers who earn $20,000 less than the average American would make. Indeed, the industry is dominated by a few players including the Indian firm Tata Consultancy accounting for over 16,000 applicants offering salaries under $70k. In the past, there was bipartisan consensus that the scheme was facilitating worker exploitation with the most infamous case being outgoing laid-off qualified workers at Walt Disney being forced to train incoming workers with the same qualifications. In 2016, Sen Jeff Sessions of Alabama and Texas’ Ted Cruz introduced legislation into the U.S. Congress requiring companies to pay H-1B applicants at least $110,000 in salaries. On the left, Senator Bernie Sanders criticised the H-1B programme for enabling worker exploitation. In 2017, Trump signed an executive order suspending for up to 6 months all expedited or premium processing of H-1B petitions. Speaking on the proposal he mentioned that:

“Right now H-1B visas are awarded by random lottery and many of you will be surprised to know that about 80pc of H-1B workers are paid less than the median wage in their fields”.

The latest controversy erupted after Trump’s pick to head the White House’s AI task force mentioned that he would like to raise the current cap of 65,000 H-1B workers per year. Musk has been adamant about how essential the H-1B scheme is for the tech sector tweeting in response to critics of the scheme: “The reason I’m in America along with so many crucial people who built SpaceX, Tesla, and hundreds of other companies that made America strong is because of H-1B.” Musk, playing the role of the painter of the animal constitution in Animal Farm who changed “four legs good two legs bad” to “four legs good two legs better”, managed to secure an 1-80 from the incoming president of Orwellian proportions. In an interview with the New York Post, Trump sided with Elon Musk and the other tech bros in claiming to always have been a fan of the scheme: “I’ve always liked the visas, I have always been in favour of the visas. That’s why we have them,” he said. “I have H-1B visas on my properties. I’ve been a believer in H1-B… it’s a great program.” This has caused divisions within the populist right wing in America. Several figures including former Governor and US Ambassador to the UN Nikki Haley have criticised Trump’s stance with Musk getting into several heated X spats with detractors of his stance on H-1Bs. The debate surrounding H-1B goes to the very heart of the rot that has been allowed to flourish in America’s tech space allowing greedy conglomerates to undercut American workers by dampening their wages. In the book Lab Rats: How Silicon Valley Made Work Miserable for the Rest of Us Dan Lyons of Newsweek, who used to work for a tech startup, highlights how toxic and downright contemptible the industry heads are with 24/7 enthusiasm along with stress mandatory. He also mentions the impact the industry has had on wages which remain static, particularly for young people:

“Real wages (adjusted for inflation) have been flat or down for decades. Millennials earn 20 percent less than their parents did at the same stage of their lives, according to a 2017 study by Young Invincibles, an advocacy group”.

According to one study from the University of Michigan, tech wages would have been 5.1pc higher in the absence of the H-1B scheme. On top of suppressing wages the tech world is full of mediocre and self-centred individuals who look down on others despite their inadequacies:

“A warning to young entrepreneurs: take money from a venture capitalist, and you’ll end up working for some smug, sarcastic, know-it-all prick… who will constantly tell you that you’re not working hard enough while he spends his days getting into arguments on Twitter” - remind you of anyone?

This subset of people have managed to maneuver themselves into a U.S. administration providing them free rein to set forth their edicts. Trump has quite clearly taken a side in the MAGA civil war and it’s not with MAGA 1. 0 but with MAGA 2.0: those who co-opted the movement having previously been more aligned with left-of-centre politics.

A second Trump term will see a continuation of the policies enacted in the first term. However, this time around the three core pillars that defined the movement being onshoring jobs, cutting the trade deficit and combating irregular migration have been realigned to suit the needs of the tech bros.